Checks might appear outdated, but they still have important uses in our system of finances.

A well-written check leaves a paper trail for your transactions, and can be used if electronic payments are impossible, and sometimes prevents a convenience fee for online payments from being charged.

This detailed guide covers all the cheque writing details, ranging from knowing the different parts of a cheque to writing one successfully.

We’ll guide you through everything step by step and give real examples so that you can write a check with confidence and don’t make common mistakes.

Parts of a Check You Need to Know

Before explaining how checks can be written properly, we must first look for some of the features that standardly appear in a check.

Below are some of them:

- Personal Information: This is situated at the top left corner and contains your name and address.

- Bank Information: This includes your name and the logo of your bank clearly printed on the check.

- Check Number: This is found at the top right corner and also in the MICR line at the bottom of the check. This unique number helps track your check transactions.

- Date Line: This is the place where you will add the date, either a previous or a future date (post-dated checks).

- Payee Line: These lines start with “Pay to the Order of” and here you will put the name of the person or business who will receive your payment.

- Dollar Box: This is a small box where you write the payment amount in numerical form.

- MICR Line: This is short for Machine Readable Characters at the bottom of the check that allow for automated processing.

Step-by-Step: How to Fill Out a Check

In order for a check to stay valid and legible while being processed, it is important to strictly adhere to several fundamental steps when drafting it.

Never Worry About AI Detecting Your Texts Again. Undetectable AI Can Help You:

- Make your AI assisted writing appear human-like.

- Bypass all major AI detection tools with just one click.

- Use AI safely and confidently in school and work.

Let us break down the process into individual parts:

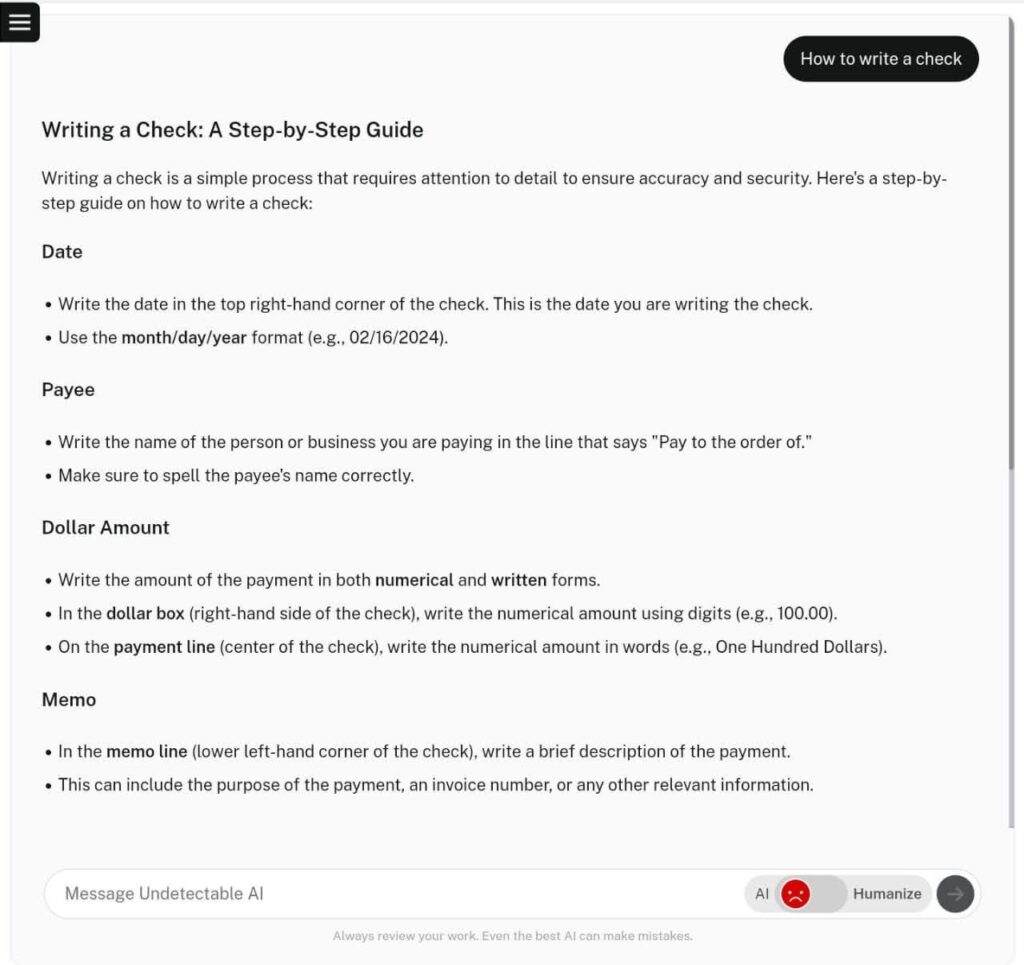

- Write The Date

Begin by writing the current date on the check at the upper right hand portion of the check, on the line that says “Date”. It is important as it gives the date when the check was created and the date when it must be deposited.

If you want the best results, use the MM/DD/YYYY format which is customary in the USA. For example, write May 9, 2025 or 5/9/2025.

Make your writing readable and don’t use words that can confuse others.

You can write a post-dated check, but remember not all banks promise to hold the check up until the designated date for payment.

- Write The Payee’s Name

Once you have written the date, add the full name of the person or company you are paying on the “Pay to the Order of” line.

Reference the full official title or business name offered. Write clearly and avoid abbreviations.

Check the spelling twice since a wrong name may not allow the payee to deposit or cash the check.

Try to avoid leaving space before or after the name even to avoid tampering. For instance, rather than writing just “John” or “Hardware Store”, write “John A. Smith” or “Ace Hardware Store.”

Furthermore, making sure the payee’s name is both accurate and legible is the only way to ensure your payment reaches its intended destination without a hitch.

Plus, if you find yourself running out of room on the line, Undetectable AI’s Acronym Generator can help you simplify long business names into short, recognizable abbreviations when writing a check, allowing you to maintain a professional appearance while fitting all necessary details into the small space provided.

- Write The Amount in Numbers

In the small box on the right side of the check, write the payment amount in numerical form.

Write the dollar amount close to the dollar sign ($) printed on the check. Include cents as a decimal point followed by two digits, such as $125.75.

Even without cents, always write zeros after the decimal: $125.00. Double-check that at least the digits are legible and when space permits use a line to mark the amount’s end to discourage any change.

When writing a check that is thousands and cents, remember to use commas for readability purposes. For example, $1,250.38 is clearer than $1250.38.

- Write The Amount in Words

On the line below “Pay to the Order of,” write out the dollar amount in words to confirm the numerical value.

Start at the far left of the line and write the dollar amount in words.

Follow the dollar amount with the word “and,” then write cents as a fraction over 100. Draw a line through any unused space until the word dollars.

For example, $125.75 would be written “One hundred twenty-five and 75/100 Dollars”, whereas $1,250.38 would be written “one thousand two hundred fifty and 38/100 Dollars”.

It is very important to know how to write cents on a check properly. Express the cents as a fraction out of 100 always, such as 75/100 or 38/100.

- Add a Memo (Optional)

The memo line location is the bottom left part of the check and it is used to indicate the purpose of the payment.

Write a short note accompanying the check saying what the check is for in such terms as “May rent,” “Invoice No. 12345,” or “Account No. 987454321.”

Ensure to include reference numbers if paying a bill or note account numbers if making a payment on an account.

Although this is optional, filling out the memo line helps with record-keeping and may be required by some payees for processing.

- Sign The Check

The final and most important step is signing the check on the signature line at the bottom right corner.

Use the same signature that’s on file with your bank and sign only after you’ve filled out all other fields. Additionally, never sign a blank check.

Without your signature, the check is invalid. Your signature authorizes the bank to release the funds from your account to the payee.

Example of a Properly Written Check

Here is a walk through of an example of how to write out a check for $1,275.50 to Jane B. Smith for home repairs:

- Date: May 9, 2025

- Pay to the Order of: Jane B. Smith

- Amount in Numbers: $1,275.50

- Amount in Words: One thousand two hundred seventy-five and 50/100 Dollars

- Memo: Home repairs

- Signature: [Your signature]

This check has all the necessary information. Numbers and written amounts are the same and thus it is ready for depositing or cashing by the payee.

Common Mistakes to Avoid

Even with seemingly simple tasks like writing a check, mistakes can happen.

Here are the most common errors to avoid:

- Mismatched Amounts: Writing the wrong amount is perhaps the most critical error. When the numerical figure is different from that written, banks mostly prefer to pay the written amount. Such a misalignment tends to create discrepancies around payments that necessitate additional accounting adjustments. Always double-check that both amount formats match exactly to prevent confusion and potential financial issues.

- Missing Signature: An unsigned check is invalid and will be disapproved by any financial institution. Your signature is what, according to the law, allows the bank to transfer funds out of your account. Therefore, this last step is irreplaceably vital. This is something many people forget when they’re in a hurry and it can lead to the delay of payments.

- Post-Dating Issues: While you can write a future date on a check (post-dating), many people don’t realize that banks may still process it when presented, regardless of the date written. This can cause problems if you’re counting on funds being available at a later date. Check with your bank about their specific policies on post-dated checks.

- Wrong Payee Name: A misguided spelling of a payee’s name or an unwarranted use of a nickname in place of his legal name can cause numerous problems with deposits. If the name doesn’t go along with the account or identification details, the depositing of the check may get stuck for the payee. Financial institutions are strict about payee verification to prevent fraud.

- Illegible Writing: Illegible handwriting is a surprisingly common problem that leads to processing errors or rejected checks. Bank employees and automated systems need to clearly read what you’ve written. Take your time to write neatly, especially when writing dollar amounts and the payee’s name.

- Insufficient Funds: Writing a check for more money than you have in your account leads to bounced checks and substantial fees from both your bank and possibly the recipient’s bank. Some financial institutions also report bounced checks to credit bureaus, potentially damaging your credit score.

- Writing in Pencil: Under no circumstances should a pencil or erasable ink ever be used for writing checks. Use blue or black permanent ink every time to avoid tampering with alteration of check details. This is a low-profile but crucial security check that many people tend to ignore.

- Mathematical Errors: Mathematical errors when recording the check in your register can wreak havoc on your account balance. Always subtract the correct amount immediately after writing the check to maintain an accurate record of available funds. Quite a lot of overdraft fees come from simple mathematical errors.

In case you have any more questions on how to write out a check, you can use our Undetectable AI Chat to receive immediate answers to specific questions like how to write a check with cents correctly.

You can also look through other Undetectable offerings to check other features that suit you.

Don’t miss the chance to explore our AI Detector and Humanizer in the widget below!

How to Cancel or Void a Check

Sometimes you may need to revoke a check you have already written or void a blank check for purposes of setting up direct deposits or automatic payments.

To void a blank check, write “VOID” in large letters across the front of the check in permanent ink (preferably black or blue).

Place the word on the bill or check, but not such that it obscures the routing and account numbers.

It is important that you record the voided check number in your register and note why you voided it for your records.

Provided that you need to stop payment on a check you’ve already written, contact your bank as soon as possible and provide the check number, amount, and payee information.

Be prepared to pay a stop payment fee (typically $20-$35).

Remember that most stop payment orders last for six months, so you ought to enter this fact in your check register.

Keep in mind that you cannot stop payment of a cashier’s check or money order; once a check is cashed or deposited, you cannot stop payment.

FAQs About Writing Checks

How To Write a Check With Thousands And Cents?

When writing a check for an amount in the thousands with cents, precision is essential.

In the number box, write the full amount with commas separating thousands and a decimal point for cents.

In words, write “One thousand two hundred seventy-five and 50/100 Dollars.” Always double-check that both representations match exactly to avoid processing issues.

How To Write Cents On a Check?

Cents have to be written as a fraction over 100 at all times. For $10.25, write “Ten and 25/100 Dollars”; write for $ 150.01 “One hundred fifty and 01/100 Dollars”.

If there are no cents, write “and 00/100” or draw a line: “One hundred fifty and XX/100 Dollars.” This standard form guarantees clarity and avoidance of tampering.

How Long Is a Check Valid?

Personal checks are generally valid for 6 months (180 days) after the date written on them.

Some banks may honor older checks at their discretion, while government-issued checks and certified checks may be valid for up to one year.

If a check is older than six months, it’s best to request a new one from the issuer to avoid potential rejection.

How To Write Out a Check With Errors?

If you make a minor mistake while writing a check, such as a slight misspelling in the payee name, draw a single line through the error, write the correction above it, and initial near the correction.

For more significant errors, write “VOID” across the check, record it as void in your register, and start with a new check to ensure proper processing.

Final Thoughts

Knowing how to write out a check correctly is a fundamental financial skill that remains relevant today.

With this guide, you can be assured of your payments being processed smoothly and securely.

Proper check writing protects against fraud and processing errors while maintaining accurate records that help you manage your finances effectively.

If you have questions about writing checks, our AI Chat feature provides personalized guidance for all your check-writing needs.