There are two fundamental ways to make money.

One where you trade your time and energy for a paycheck, what we call active income, and another where you have an asset that keeps earning, better known as passive income.

Neither form of income is inherently “better” than the other. They just function differently.

Today, I’ll discuss the mechanics of what is active income, how it differs from passive income, the different types of active earnings, and the practical realities of landing and sustaining a paycheck.

Let’s get right into it.

Key Takeaways:

- Active income is time-for-money. You get paid via salaries, wages, commissions, tips, etc., when you show up at work and do your required tasks.

- It is a more stable mode of income with predictable paychecks and additional benefits like insurance and PTO, but it’s capped by your time.

- Passive income comes from assets like rentals, dividends, or royalties, where money flows with minimal ongoing effort.

- The smart play is earning both active and passive income. Use your active income to fund passive assets and reinvest your returns.

Definition of Active Income

Active income is the money you earn by trading your time and energy for compensation.

It’s the classic “work hard, get paid” model, which includes salaries, hourly wages, commissions, professional fees, tips, etc.

In tax terms, the IRS labels active money as compensation in exchange for services.

Never Worry About AI Detecting Your Texts Again. Undetectable AI Can Help You:

- Make your AI assisted writing appear human-like.

- Bypass all major AI detection tools with just one click.

- Use AI safely and confidently in school and work.

Now, the services could be offered by locking into a 9-to-5 or by billing clients on your own terms.

However, your earnings are directly linked to your effort.

No work equals no paycheck.

Now, what is active income if you’re self-employed or have a stake in a business?

According to the IRS, your income is called “active” if at least one of these is true:

- You log 500 or more hours a year in the business

- You’re the one doing the majority of the work

- You put in over 100 hours, and no one else on the team works more than you

Difference From Passive Income

Passive income is the money earned with little to no ongoing involvement after the initial setup.

It includes:

- Rental income

- Dividends

- Royalties

- Interest from investments

The core difference between the two is that passive income makes you money out of your assets (capital, property, intellectual property) rather than hours in a workday.

To earn active income, you must perform and be punctual at your work settings.

Passive income, on the other hand, doesn’t care if you’re sipping coffee at home in pajamas.

Ideally, you could increase your passive income to no limits because it is not capped by your time and energy.

Types of Active Income

There are many different types of active income, each of which differently exchanges effort for earnings.

They include:

- Salary or wage, where you agree to sell your weekdays (and sometimes your sanity) to an employer in exchange for a predictable paycheck. It is the backbone of the traditional labor market.

- Commissions, which reward your performance rather than attendance. Sales professionals, for example, get paid via this model. If they close more deals, they make more money.

- Freelance or professional service income, where specialists, i.e., consultants, designers, lawyers, accountants, etc., bill their clients for their time and expertise. If you’ve got scarce skills and a strong reputation, it’s a lucrative form of active money.

- Tips and gratuities are technically a form of active income, too. Service workers like bartenders or rideshare drivers can get a surprisingly generous income stream from customer goodwill.

- The gig economy, where the meter runs only when you work by renting skills by the hour, as in driving or delivering.

All these types of active income share one unifying trait, i.e., you’re directly tied to the output.

The money stops the second you stop working.

How Active Income Works in Practice

Almost every form of active income requires you to formally enter the workplace (or work from home). Before you ever clock in, you need to sell yourself to an employer.

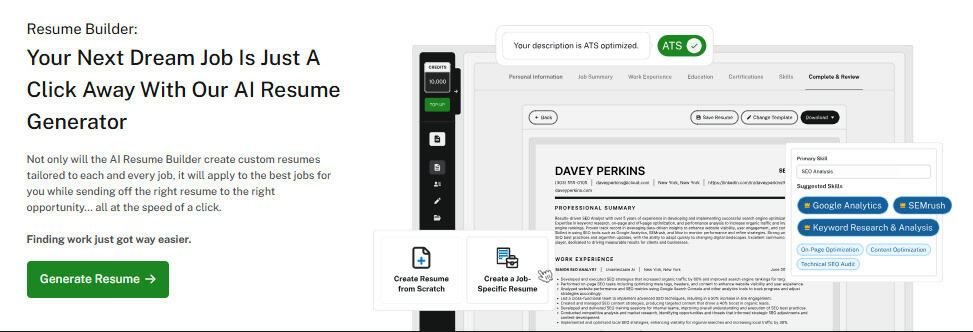

It starts with your resume, which has to pass the dreaded ATS (Applicant Tracking System) scan before a human even lays eyes on it.

Miss the keywords mentioned in the job description, and you might as well have sent your resume straight into a black hole.

There also comes the job application phase, where you send your application to an employer, hoping to get called for an interview.

If you survive that, you must sit in at least one round of interviews where you try to convince strangers that you’re competent and won’t ghost the company on day two.

There’s also freelance or gig-based work.

To do that, you need to sign up on platforms like UpWork and apply to the freelance job posts posted by clients or make your project catalogs that clients can buy.

Luckily, we were born at the time when part of this process is made easy via AI tools.

You at least don’t have to stare at a blank page wondering how many ways you can say “I’m passionate about this role,” as you apply for different jobs.

Undetectable AI offers a resume builder and a cover letter generator that personalize your job application documents while making sure they sound like you wrote them yourself.

If you’re sending out multiple resumes or cover letters, it helps to make sure they all sound like you. That’s where Our Undetectable AI’s Bulk Scan AI Content makes a real difference.

It lets you scan batches of application documents at once and instantly shows which ones might sound too mechanical or AI-written.

You’ll see clear, color-coded results that help you fine-tune every piece before submission so your applications feel natural, professional, and truly human.

Benefits of Active Income

There’s a reason, or rather, many reasons, why over 60% of the US population is actively employed.

The biggest benefit of active income is stability. You know that if you show up and get your work done, your paycheck will land on schedule.

The predictability makes it far easier to budget rent, groceries, or the occasional impulse buy you’ll regret later.

Active income also gives you financial credibility.

Lenders or landlords, for example, want some kind of proof of reliable earnings before they make a deal with you, and a steady salary or wage gives you that.

With active income, promotions, and performance bonuses are usually clear milestones.

Employers love to tie compensation to results, so if you deliver good results, your income is going to increase.

Probably the biggest benefit of an active income stream are the amenities you get beside a paycheck, e.g., health insurance, retirement contributions, paid time off, training stipends, and networking opportunities.

Another underrated advantage of active income is how relatively easy it is to get started. You don’t need big assets to earn money as in a passive income stream.

Just have a system like the Undetectable AI’s automated Smart Job Applier in place, and automatically pitch to relevant positions.

Read here how the job market looks in 2025.

Drawbacks of Active Income

Active income keeps your bills paid, yes, but it comes with a set of strings that aren’t very obvious when you first sign that offer letter.

The most glaring drawback is its direct tie to your time and energy.

Call it the “treadmill effect,” where the moment you step off, the money stops flowing.

You may have leave policies, but there’s no guarantee that they’ll be generous enough to cover for your vacations and family emergencies.

There’s also a hard ceiling on growth. No matter how talented you are, there are only 24 hours in a day that you can monetize.

You might double your salary over a decade through promotions, but the pace is quite slow when compared to scalable passive income streams.

Active income is taxed at the highest rates because governments classify it as “ordinary income.”

Passive sources like capital gains or dividends get more favorable treatment.

Also, active income comes wrapped in workplace culture, which isn’t always supportive or even tolerable.

In case you get stuck at a place with heavy politics and micromanagement, you’ll burn out really soon.

Common Examples of Active Income Careers

Active income careers are by far the most common forms of employment. You’re surrounded by them daily without even realizing it.

Corporate employees, from the lowest-tier workers all the way up to executives who earn the biggest checks, all get paid via active income.

Sales jobs classically pay via the commissions model.

Real estate agents, insurance brokers, high-ticket B2B sales reps, etc are some examples of active income sales careers.

Freelancers also sit in the active income camp. And so do lawyers and doctors with billable hours or patient consultations as the metric that drives their earnings.

Besides, service workers like rideshare drivers, delivery couriers, virtual assistants, and task-based workers all earn actively by the job or by the hour.

Active Income vs Passive Income

Now that we know “what is active fixed income” in quite a lot of detail, let’s compare it with passive income.

Key Differences in Effort, Time, and Scale

We’ve clearly established how active income demands constant effort.

You need to show up, log hours, hit quotas, and deliver projects to see money hit your account. It’s labor-for-cash in real time.

Passive income, by contrast, is front-loaded, i.e., the effort comes early and once the assets are in place, your continuous efforts shrink quite a lot.

Active income has a hard cap with ony 24 hours a day, minus whatever you need for sleep and Netflix.

Even if you include your active side hustles, your physical and mental bandwidth limit how much you can earn.

Passive income, however, scales with time in your favor. Your rental property doesn’t care if you’re at the beach.

Your stock dividends also don’t stop because you skipped Monday.

In short, active income keeps you busy, but passive income has the potential to keep you free if you plan it out smartly.

Why You Need Both for Financial Stability

Active income gives you stability today. It pays your bills and provides the financial credibility you need for mortgages, credit, or just proving to your landlord you can cover rent.

But the catch is, it is fragile. Lose your job for any reason or face a downturn in your industry, and the cash flow stops cold.

Passive income streams, however, keep money coming in even when you’re not “on.”

At the same time, passive income on its own is rarely enough in the early years. You need time and capital to build it.

That is why professionals who look financially bulletproof have both income sources, a reliable salary or consulting practice to keep things steady, and a portfolio of investments quietly compounding in the background.

Transitioning From Active to Passive Income

You obviously can not quit your job one day and wake up the next with dividend checks in the mail.

It’s a gradual, strategic shift that starts while you’re still deep in the active grind.

The best way to transition from active to a passive income stream is to invest a part of your active income.

You’ll have to dedicate a portion of every paycheck for assets that generate income without your daily involvement.

Most people treat active income like a faucet that’s always on, spending as fast as it flows.

If you want passive streams later, you need to redirect some of that flow into modes that work for you long after you stop. Start small if you must, but keep it consistent.

And as your passive assets grow, you reinvest the returns instead of cashing them out prematurely.

The earlier you start reinvesting, the faster your passive streams will grow.

It’s not glamorous in the beginning, and it requires patience.

But the payoff is freedom from the treadmill of trading hours for money, freedom to weather economic downturns, and freedom to design a financial life that doesn’t collapse the moment you take a vacation.

Enhance your content’s authenticity—try the AI Detector and Humanizer now.

Conclusion

We know now what is active income in great detail. Active income is what pays the bills, but if we’re being honest, landing an active income job is no small feat.

You must create resumes that survive ATS scans, write cover letters that don’t sound like a robot wrote them, and apply to dozens of roles before getting called for an interview.

Undetectable AI’s suite of tools is built to make this process easy.

With the AI Resume Builder, Cover Letter Generator, and Smart Job Applier, you can streamline applications and boost your chances of getting noticed.

These tools cut through the grunt work so you can focus on preparing for interviews.

Explore our AI-powered resume builder, cover letter generator, and smart job applier to skip the time-wasting grunt work and get hired faster.

Start using Undetectable AI today and take the next step toward landing your ideal role.